Singapore now trades over 300 tons of gold every year. This makes it a key player in Asia’s gold market. The city’s growth in gold trading comes from a mix of history, tax breaks, and changing market trends.

It has a strong set of rules and modern facilities. This has made it a top choice for investors worldwide. This article explores how Singapore became a major player in the global gold market.

Introduction to Singapore as a Gold Trading Hub

Singapore is a major gold trading center, located between China and India. Its location helps move gold easily to meet global demand. The city is known for its stability and business-friendly environment, making it attractive for gold trading.

Many investors, both big and small, are drawn to Singapore for gold trading. They use various strategies like hedging and speculation. Online gold trading platforms also make it easier for people to invest in gold from anywhere.

from SBMA.org

from SBMA.org

Singapore’s strong rules and investments in infrastructure boost its gold trading reputation. Efforts to make the gold market more efficient and clear help build trust among investors. This makes Singapore a leader in gold trading not just in Asia but worldwide.

Historical Context of Gold Trading in Singapore

Gold trading in Singapore has a rich history, making it a key part of the country’s identity. It all started with local goldsmiths who were key in early transactions. These goldsmiths helped create a basic gold market that drew in merchants from all over.

Early Gold Trade Practices

In the early days, goldsmiths were both artists and traders. They offered custom pieces and set prices based on weight and skill. Trade routes connected Singapore to other regions, making gold a key item for traders in Southeast Asia.

Evolution of the Gold Market

The gold market has grown a lot thanks to global changes. New tech and online trading platforms have changed how gold is traded. Groups like the Singapore Bullion Market Association have helped make the market more competitive. This has made Singapore a big player in the global gold market.

| Period | Characteristics | Driving Factors |

|---|---|---|

| Early Trade | Goldsmiths handling personal transactions | Local craftsmanship and commerce |

| Globalization Era | Established electronic trading platforms | Technology and communication advancements |

| Contemporary Market | Competitive trading initiatives | Regulatory support and market evolution |

Strategic Tax Policies Supporting Gold Trading

Singapore has become a top gold trading center thanks to smart tax policies. In October 2012, it removed the Goods and Services Tax (GST) on investment-grade gold. This move makes buying gold cheaper for investors, making Singapore more appealing for trading.

This change helps both big investors and small ones. It makes gold trading more attractive, boosting the market.

Removal of GST on Investment Gold

Removing GST on investment gold makes it easier to buy. This move helps the gold trading sector grow. It lowers the cost for new and experienced investors.

The Approved Refinery and Consolidator Scheme (ARCS) also helps. It lets refiners bring in gold without paying GST. This cuts costs and encourages more trading.

Impact of Tax Advantages on Investors

The good tax rules attract foreign investors. This brings more liquidity and activity to the market. More people are joining, making Singapore a leading gold trading place.

Investors get to enjoy new trading chances. This is good for the region’s gold investment scene.

Infrastructure Development Bolstering Gold Trading

Infrastructure is key to the gold trading market in Singapore. The country has invested in top-notch facilities, making it a major player globally. This investment has built a strong system for gold processing and trading, focusing on physical gold.

Establishment of LBMA-Accredited Refineries

LBMA-accredited refineries like Metalor have boosted Singapore’s gold refining. These refineries meet international standards, handling gold efficiently. This meets investor needs and makes Singapore a critical gold trading center.

With better processing, trades happen faster. This makes transactions smoother and builds trust among investors.

Creation of Secure Transport and Vaulting Solutions

Secure transport and vaulting are vital for the gold market’s integrity. Companies like Silver Bullion offer advanced vault services. They have large storage and top security, boosting investor trust.

Secure solutions do more than just keep assets safe. They also improve the market, making it safer for physical gold trading. This encourages investors to keep their assets in Singapore’s gold infrastructure.

from MotherShip.com

from MotherShip.com

The Role of Singapore Bullion Market Association (SBMA)

The Singapore Bullion Market Association (SBMA) plays a big role in growing Singapore’s gold market. It works closely with the government to make the bullion sector more competitive. The SBMA also supports innovation, which helps gold investments and trading strategies.

Advocacy and Support for Market Growth

The SBMA hosts many conferences and workshops to educate people about gold. These events help industry members share ideas and learn from each other. The association aims to make Singapore a top place for bullion trading.

Initiatives for Price Transparency

The SBMA has started projects to make trading easier by improving price clarity. They publish daily gold kilobar premiums, which help traders. This makes it simpler for people to trade gold online and find new investment chances.

Geopolitical Factors Influencing Gold Demand

Geopolitical events and global economic shifts impact the gold market. They drive demand for gold. Recent tensions have made investors look for safe assets, boosting gold demand.

Singapore’s strategic location makes it key in the global gold supply chain. It’s a vital hub for gold sourcing and distribution.

The Shift in Global Gold Supply Dynamics

The geopolitical scene is changing, affecting gold supply. Disruptions in traditional gold sources highlight the need for stable trading places. Singapore is becoming a go-to spot for traders and investors.

This shift is important for understanding gold’s future flow in the market.

Emerging Market Demand and its Impacts

Emerging markets, like those in Asia, are showing more interest in gold. Countries like China and India are big players, using gold for investment and cultural reasons. This demand makes Singapore a strategic partner for these markets.

Central banks are also adding gold to their reserves. They often choose Singapore for its role in the global gold scene.

Regional Integration and Future Growth Potencial

Working with ASEAN countries is key for Singapore’s gold market to grow. As markets open up, Singapore can use these partnerships to boost its role. This will make it a major center for trade and investment.

By linking gold trading with nearby economies, more gold will flow. This will make Singapore even more important in the global gold scene.

Collaborations with ASEAN Countries

Working with ASEAN countries opens up many gold investment chances. Setting up joint ventures and agreements helps make trading smoother. It also helps share knowledge.

By building strong relationships, Singapore hopes to tap into the growing gold demand in the region. This will help it stay at the top in gold trading.

Expanding Gold Trading Market Liquidity

Keeping the gold market liquid is vital for Singapore’s growth. It aims to draw in central banks and private investors. This will make the trading environment competitive.

Setting up more facilities for clearing and settling trades will help. It will make trading more efficient and cheaper. This will help both experienced traders and newcomers.

| Aspect | Details |

|---|---|

| ASEAN Collaborations | Joint ventures and agreements to enhance trade |

| Market Liquidity | Attracting foreign investment to boost trading capacity |

| Settlement Facilities | Improvement of clearing operations for efficiency |

| Gold Investment Opportunities | Increased access to varied gold trading platforms |

Gold Investment Opportunities in Singapore

The world of gold investment in Singapore has changed a lot. Online gold trading platforms have made it easier for everyone to get into the market. Now, both new and experienced traders can join without high costs or complex steps.

Attractive Platforms for Online Gold Trading

Many platforms in Singapore make online gold trading simple. They offer tools like educational materials, market data, and live prices. These help investors make smart choices. This ease has drawn more people to invest in gold, seeing its lasting value and growth.

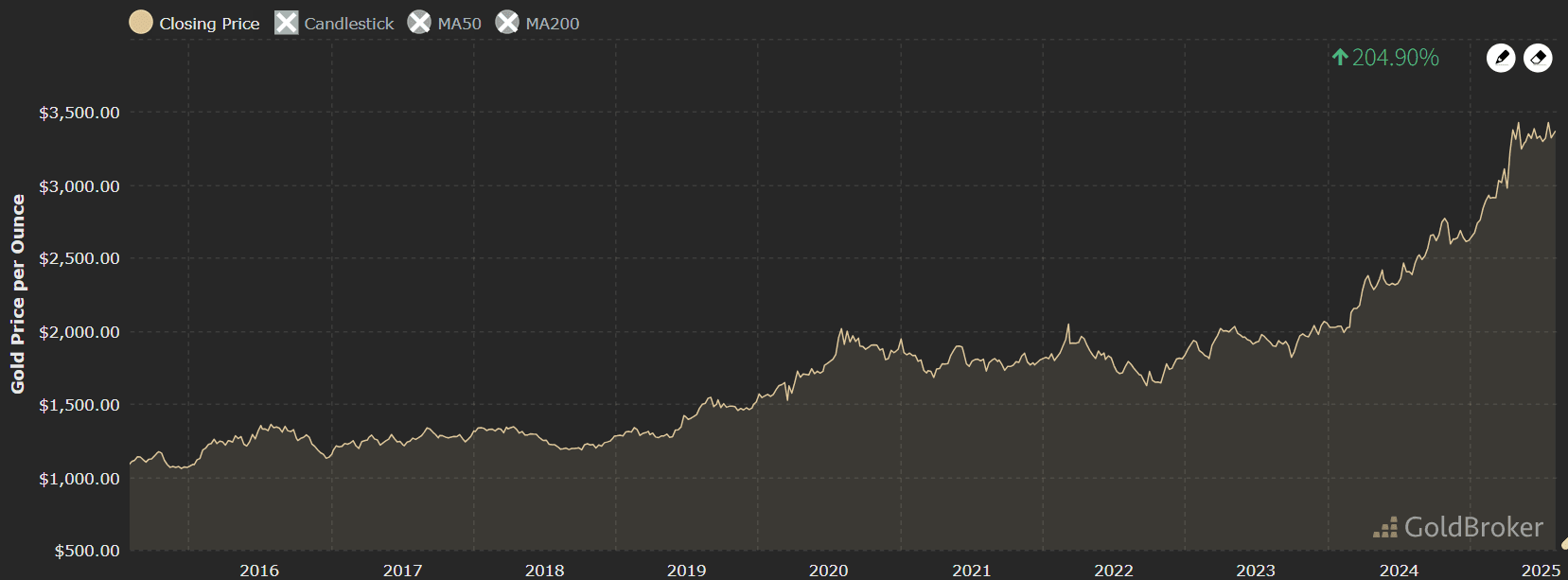

from GoldBroker.com

from GoldBroker.com

Investment Strategies for New Traders

For new investors, knowing good strategies is key. Learning from online platforms helps build a solid investment plan. Strategies like dollar-cost averaging, spreading investments, and using market data can help. These methods improve chances of success and help navigate Singapore’s gold market.

Benefits of Storing Gold in Singapore

Singapore is a top choice for storing gold. It offers strong legal protections and growing physical gold trading facilities. The legal framework is robust, giving investors peace of mind about their assets. The country’s clear rules and property rights make it safe for managing valuable items like gold.

This makes Singapore attractive to both wealthy individuals and big investors. It’s a key place for gold trading.

Robust Legal Framework and Asset Protection

The laws in Singapore for gold investment are strict and reliable. They protect investors’ rights to own and store physical gold. This boosts confidence and makes Singapore a top spot for gold storage.

The legal system’s strength makes Singapore a big player in the global gold market.

Growth of Physical Gold Trading Facilities

More physical gold trading facilities have opened in Singapore. This shows the country’s dedication to improving the investor experience. Modern vaulting services and capabilities have made Singapore a prime spot for gold trading.

These advanced facilities help investors manage their gold safely and efficiently. This solidifies Singapore’s reputation as the best place for gold trading in the region.

| Feature | Details |

|---|---|

| Legal Framework | Strong regulations ensure ownership and storage rights are protected. |

| Security | Advanced vaulting services provide secure conditions for gold storage. |

| Investor Confidence | The regulatory environment fosters trust and attracts both individual and institutional investors. |

| Market Position | Singapore is recognized as a leading gold trading hub in Asia. |

Conclusion

Singapore has become a top gold trading hub thanks to its history, smart policies, and global position. It has strong infrastructure, tax breaks, and support from the Singapore Bullion Market Association (SBMA). This makes Singapore a strong player in the global gold market.

The city-state is known for its smart gold trading strategies. These attract both local and international investors. This shows Singapore’s growing importance in the gold market.

Singapore is also set to keep growing in the gold investment world. The government is working to make trading better and easier. This makes Singapore a great place for investing in gold.

People looking to invest in gold should use trusted platforms. Places like the Far East Gem Lab are good for making informed choices.

In the end, Singapore’s mix of smart planning, good infrastructure, and rules makes it key in global gold trading. It keeps its place as a leader in the market.